澳大利亚出口这个话题在PTE真题中一直比较火。因为大家一直找不到100%的原题。今天墨尔本悉尼文波PTE培训学校就给大家找来了近似的PTE真题视频,而且提供了参考答案。希望对墨尔本PTE和悉尼PTE的考生有帮助。下面开始:

墨尔本悉尼文波PTE培训学校温馨提供本视频的Transcript:

LEIGH SALES, PRESENTER: Australia’s economic future gets more entwined with China’s all the time and that’s even before a new free trade agreement between the two countries.

The Prime Minister Tony Abbott is in China right now for APEC and when he, and the Chinese President arrive in Australia later this week for the G20, they’re expected to sign a deal.

Last year, Australia exported more than a $100 billion worth of goods and services to China. It’s already our largest trading partner, accounting for more than a third of trade.

Not everyone, though, thinks that’s a good thing, as Greg Hoy reports.

GREG HOY, REPORTER: Far from the dust and din of Australia’s many quarries, the global mining industry gathered recently in Melbourne to glean what it could from Australian mining’s rock stars.

ANDREW FORREST, MINING MAGNATE: And they’re saying to me, “Andrew, do whatever it takes to convince those people in Melbourne and Sydney and the mining industry and the banking industry wherever you go,” and that’s exactly how we got Fortescue going.

GREG HOY: But the elephant in the room here was continuing uncertainty over what is already the biggest market for commodities and a key driver of the Australian economy: China.

There’s a lot of pessimism about on China at the moment. What’s your perspective?

ANDREW FORREST: Um, I’d say that’s coming from pockets within China. I don’t think there’s any long-term cause for concern. Things go up and down, we’ve been saying it for ages, but no long-term cause for concern.

GREG HOY: The price of Australia’s biggest export, iron ore, has fallen around 40 per cent since December. While Australian miners invested heavily to ramp up production to feed Chinese growth, the Chinese economy has instead slowed enormously.

MITCH HOOKE, FORMER CEO, MINERALS COUNCIL: There are a number of projects that are not going ahead, a number that are shutting down, a number that are scaling back. We’re seeing focus on cost, so the austerity phase, you know, they call it. But the thing about the austerity phase, the challenge for the industry, is that it doesn’t become foetal position-like behaviour. You know: (Demonstrates foetal position)

GREG HOY: Today, China is cutting back on the heavy government stimulus and easy credit that had turbo-charged the Chinese economy. The resulting excess supply of iron ore and coal has driven export prices down, adding to downward pressure on the Australian dollar.

NOURIEL ROUBINI, ROUBINI ECONOMICS: I believe that China could fall towards a growth rate of six per cent or below in the next couple of years.

GREG HOY: Economist Nouriel Roubini famously predicted the GFC. Now, his company is predicting Australia’s economy will slow markedly next year, impacting on government revenues, prompting a 20 per cent slump in the dollar.

NOURIEL ROUBINI: That’s a very bumpy landing for China and it will have an impact also on commodity prices and through a variety of trade channels also in the global economy.

GREG HOY: The Federal Government thinks this is overly pessimistic, that despite global economic volatility, China’s massive modernisation efforts will continue.

ANDREW ROBB, TRADE MINISTER: We might feel a bit of a road bump, but I feel that we will pick up – if there is a bit of a road dump, we’ll pick up steam very quickly beyond that because I think so many factors are coming together, which is all good news for Australia.

GREG HOY: The Government is excited a free trade deal with China will be a game-changer for Australian exporters from agriculture to financial services. With a live cattle deal also flagged, Australia’s farmers share this enthusiasm.

SIMON TALBOT, CEO, NATIONAL FARMERS’ FED.: Look, I think it heralds a golden era for Australian agriculture. We’ve seen Australian ag’ in the last 10 years go from $3 billion to $8 billion exports to China.

DAVID MORFESI, INSTITUTE FOR INTERNATIONAL TRADE: China is already our biggest trading partner and the idea of liberalising trade with your biggest partner is logical. You’re cutting the costs of doing business and creating more opportunities with essentially your best customer.

GREG HOY: David Morfesi served as senior trade negotiator in the office of the US President, where he negotiated the free trade deal with Australia. He’s since moved to Australia and says his adopted country shouldn’t get too excited about its latest trade deal.

DAVID MORFESI: Because we sign a free trade agreement this week, next week, next month doesn’t mean that the benefit is coming this week, next week, next month. It means that we’re starting a relationship that’s going to lead to sustainable economic growth.

GREG HOY: That’s assuming all is well in the Middle Kingdom. Visiting Melbourne, the chairman of the Chinese Mining Association acknowledged his country’s economic slowdown.

WANG JIAHUA, CHAIRMAN, CHINESE MINING ASSN: (Speaks Chinese)

TRANSLATOR: He says that China now in restructuring, so it’s change your gear, and so that’s the China economy (inaudible).

WANG JIAHUA: (Speaks Chinese)

TRANSLATOR: Slowing down, little bit.

GREG HOY: Slowing down a little bit?

TRANSLATOR: Yes.

GREG HOY: The problem for Australia, even before any trade deal is done, is when China slows down a little bit, the impact is profound on exporters and not just in mining.

This is the largest wool-selling centre in the country. Here, wool is sampled, sold and sent off for processing in factories overseas. Like iron ore, the Australian wool industry has developed a heavy dependence on China.

JAMES THOMPSON, AUSTRALIAN MERINO EXPORTS: In the last 10 to 15 years, they’ve taken up to 85 per cent of the clip from Australia, and in the last 12 months, that’s peaked back to around 65s.

GREG HOY: As with iron ore, the huge Chinese demand for Australian wool has been fuelled by easy access in China to government funding and credit, which today is being withdrawn, slashing Australian exports.

JAMES THOMPSON: I just don’t think any commodity wants one particular country to be so powerful. I think you need diversity.

GREG HOY: The former US Secretary of State and presidential hopeful Hillary Clinton agrees, warning recently Australia is far too eager to increase exposure to the Chinese economy, angering the Federal Government.

ANDREW ROBB: We’re looking after Australia’s national interest. Hillary can look after the United States. We’ve got the fortunes and the jobs and the quality of life of 23 million fellow Australians that we’re responsible for. We have targeted the region as our first priority, but without ignoring the rest of the world, but this is our first priority and China’s a big part of it.

LEIGH SALES: Greg Hoy reporting

墨尔本悉尼文波PTE培训学校提供的参考答案:

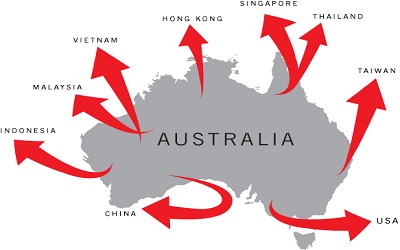

The lecture talks about recent years of Japan, America and China’s export business, and Australia should seize this opportunity to develop export business. Australia’s export destination used to isolate from North America and UK, but now the market is changing to Asia. Japan is the largest exporting country, and China is the second. But it is expected that in the near future China will become the largest exporting country to Australia. Australia should take advantage of China’s rise.

文波陪伴,PTE不难

文波陪伴,英语不难

wenbo.tv 看PTE视频的地方

文波论坛,最专业的PTE论坛

墨尔本悉尼文波PTE培训学校原创首发